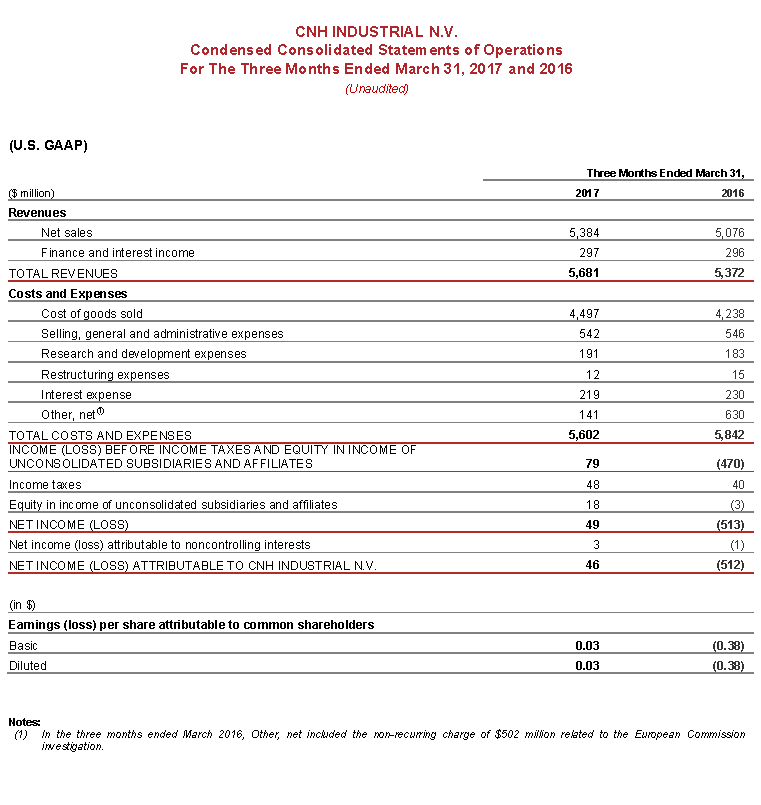

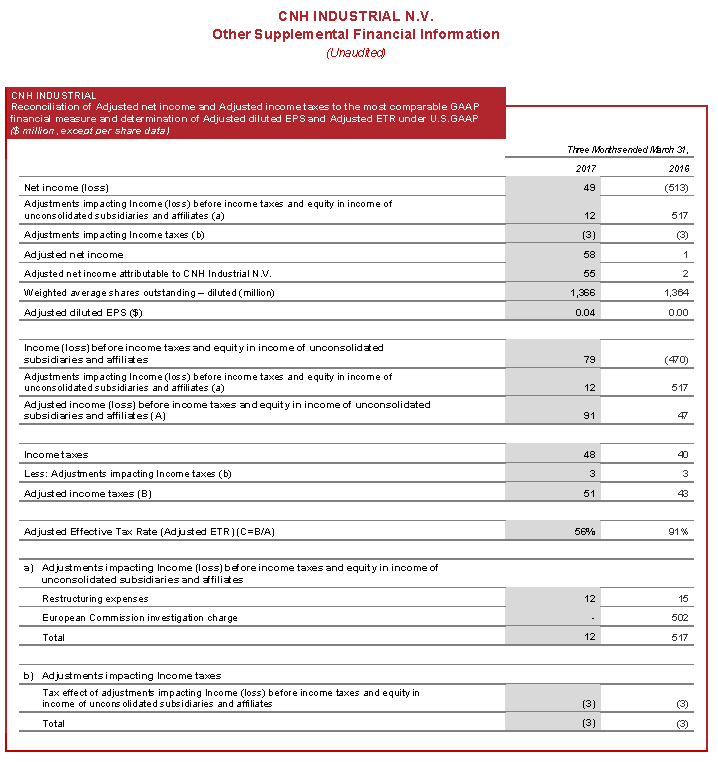

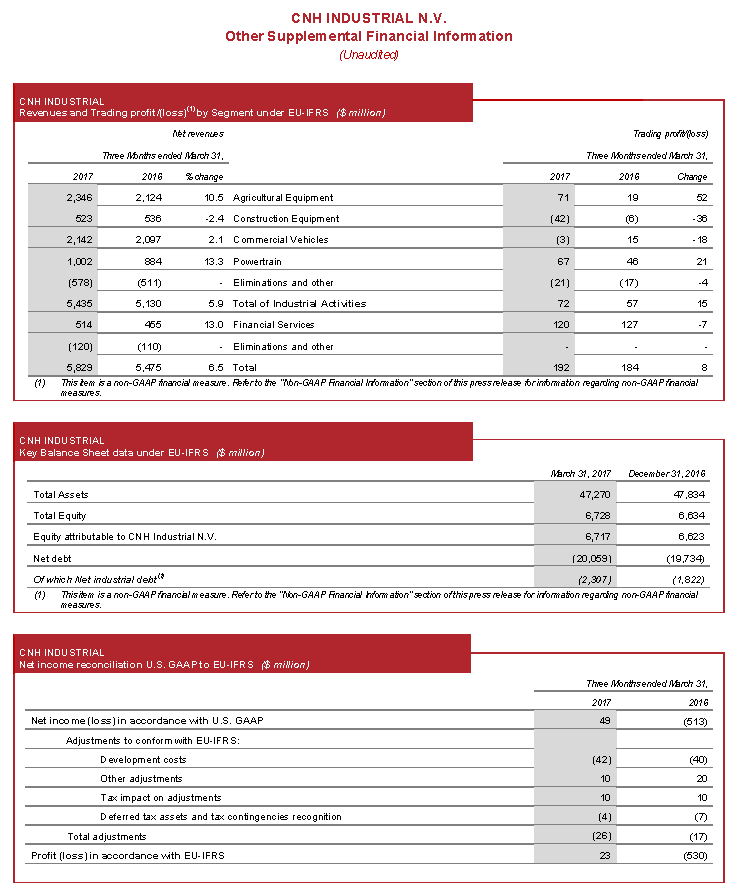

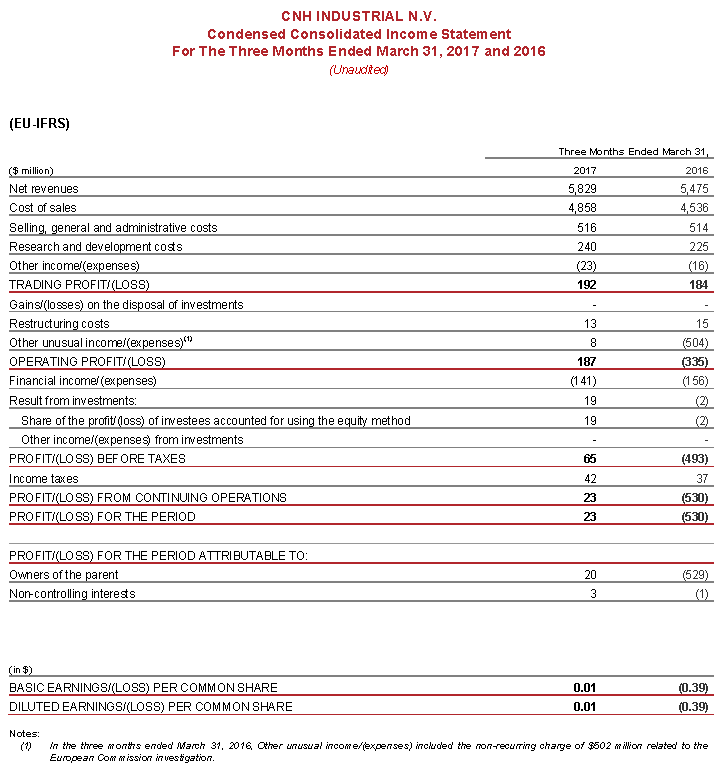

Income taxes were $48 million in the first quarter of 2017 ($40 million in the first quarter of 2016). Adjusted income taxes(1)(2) for the first quarter of 2017 were $51 million ($43 million in the first quarter of 2016). The adjusted effective tax rate (adjusted ETR)(1)(2) was 56% (91% in the first quarter of 2016), and was impacted by unbenefited losses in certain jurisdictions.

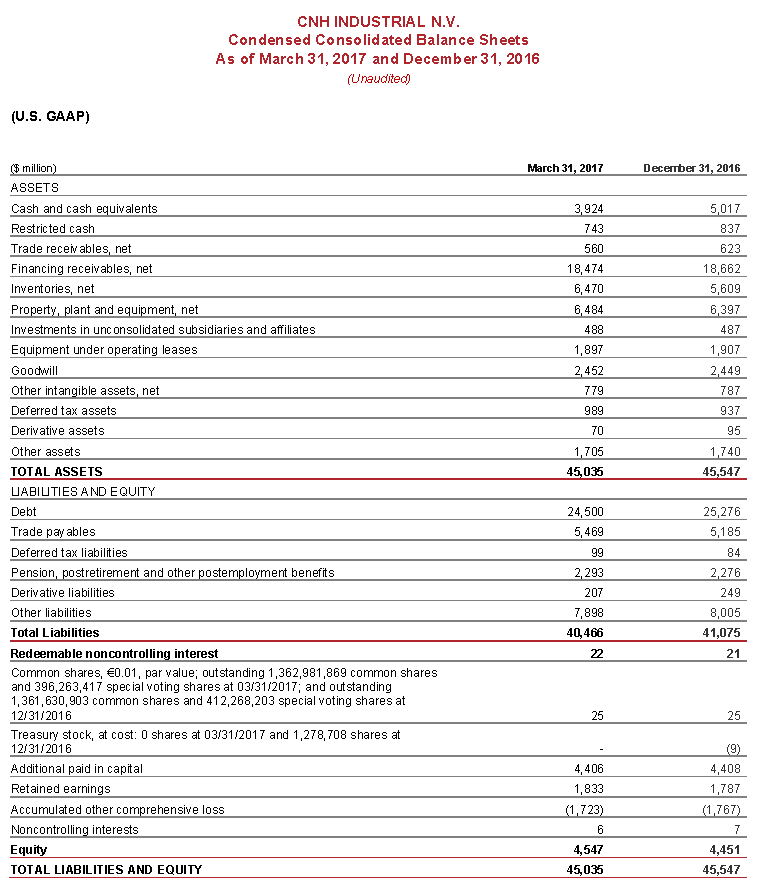

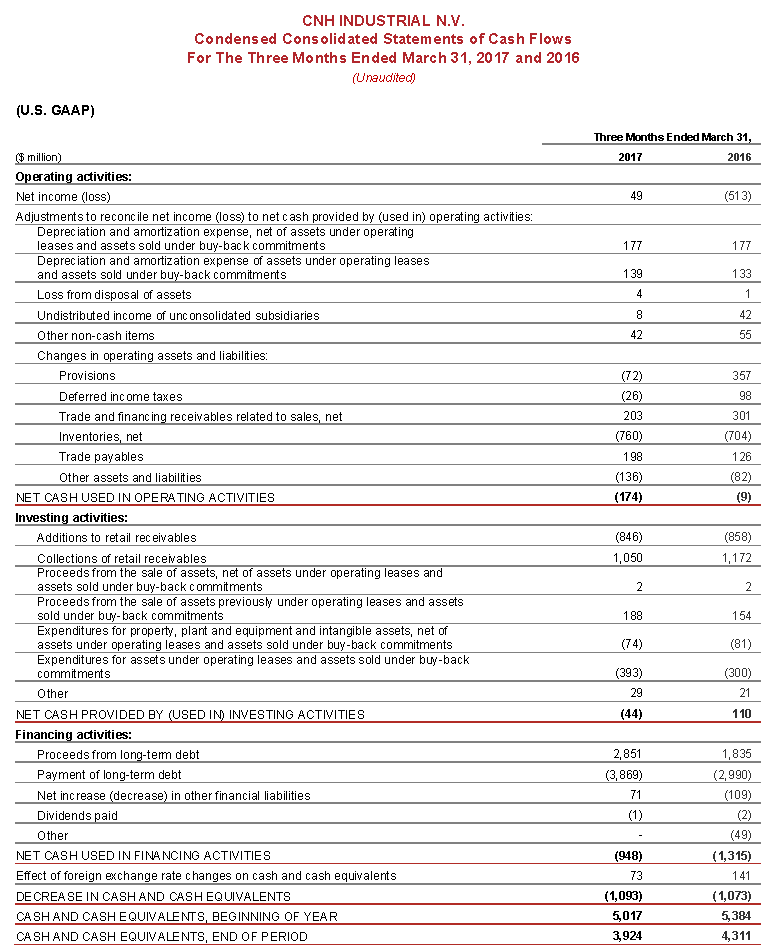

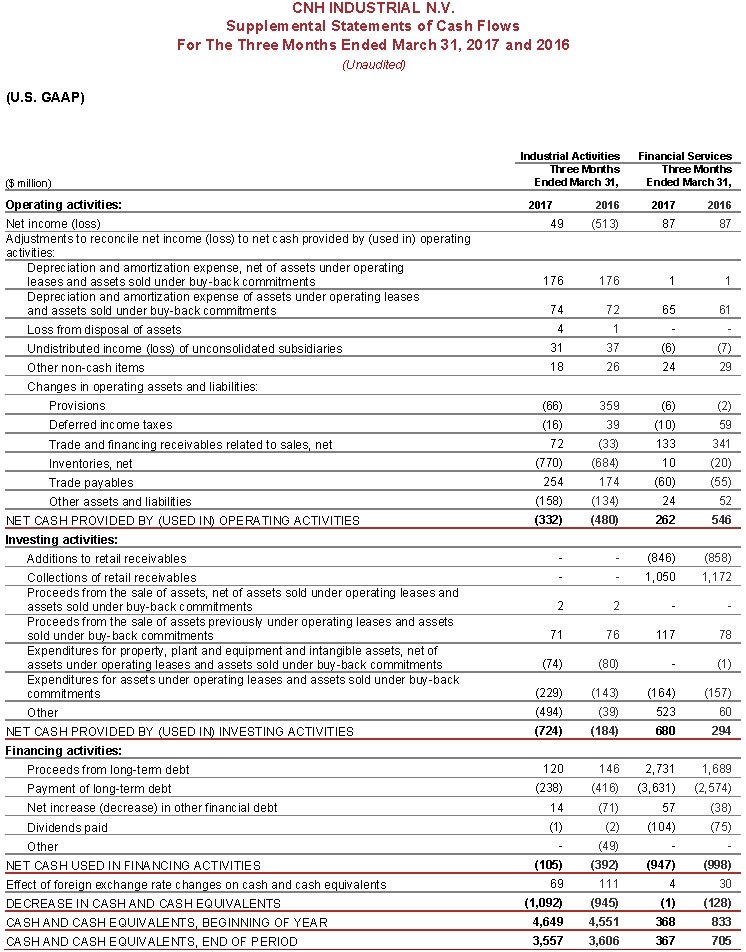

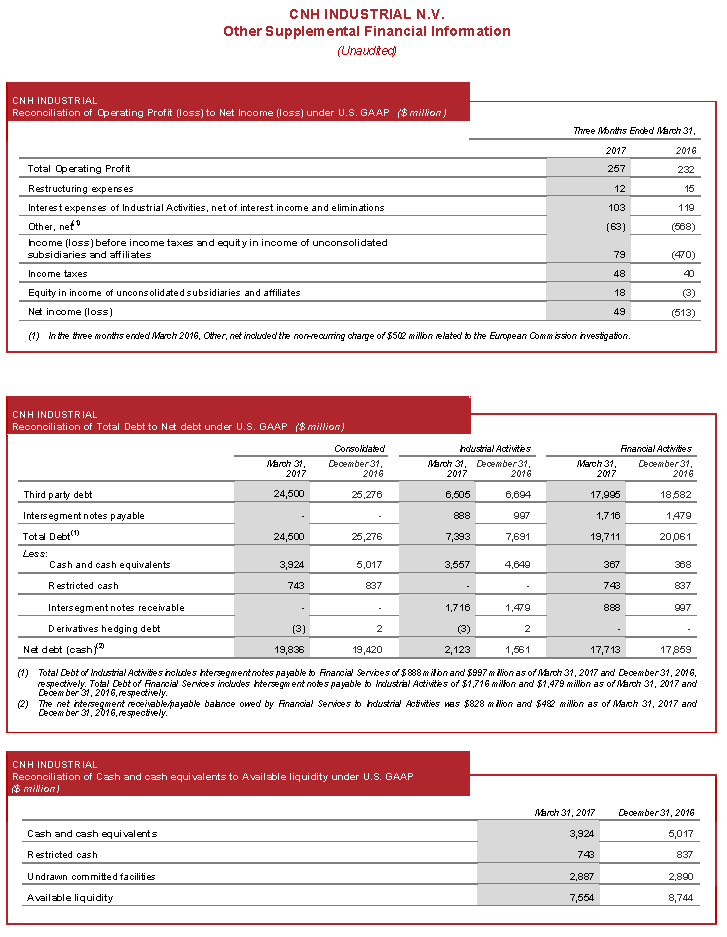

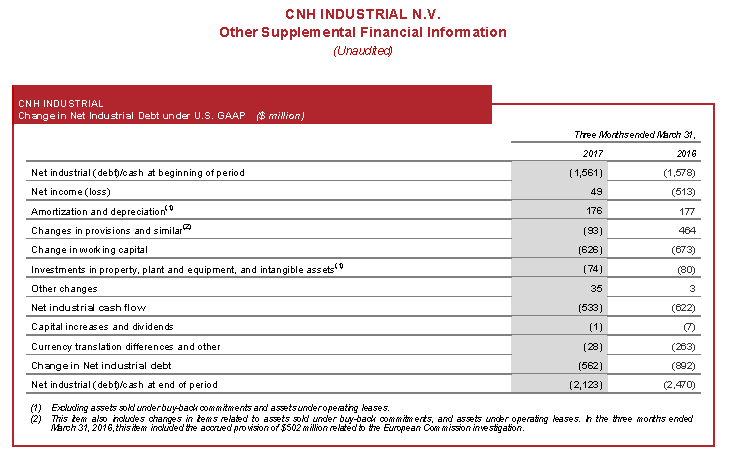

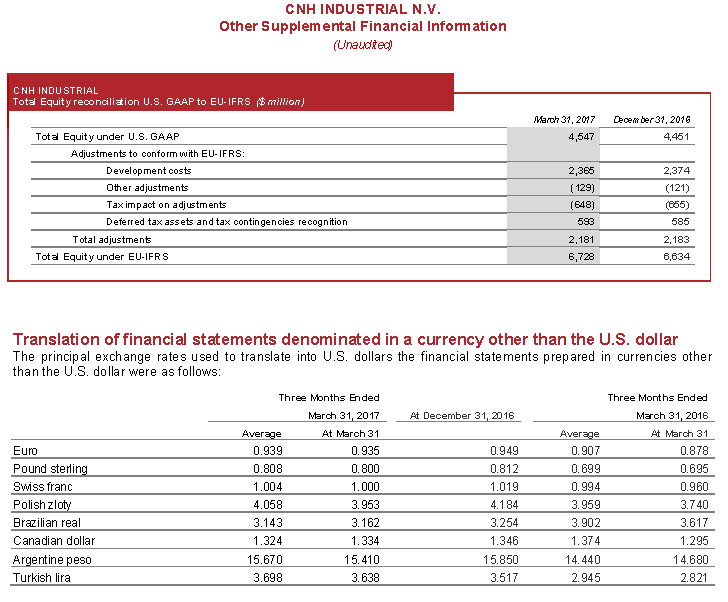

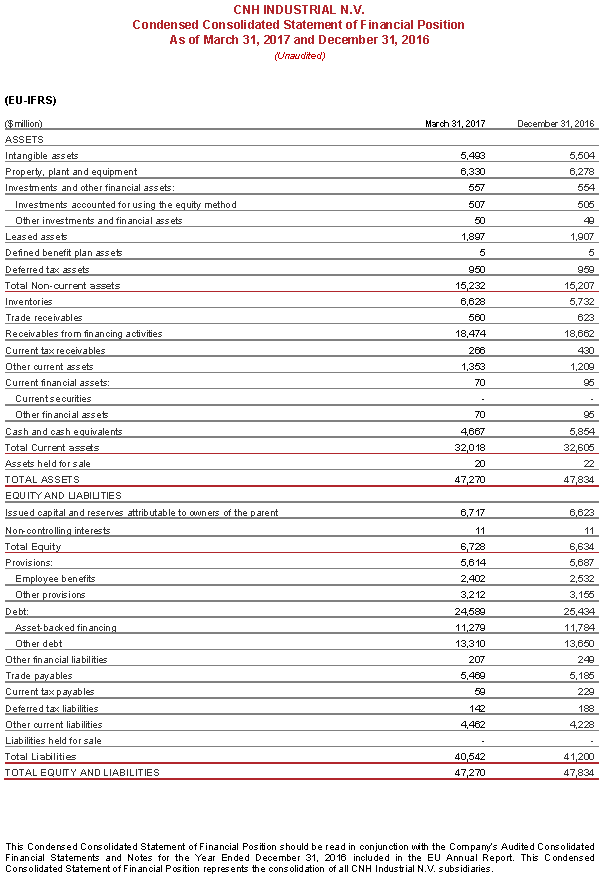

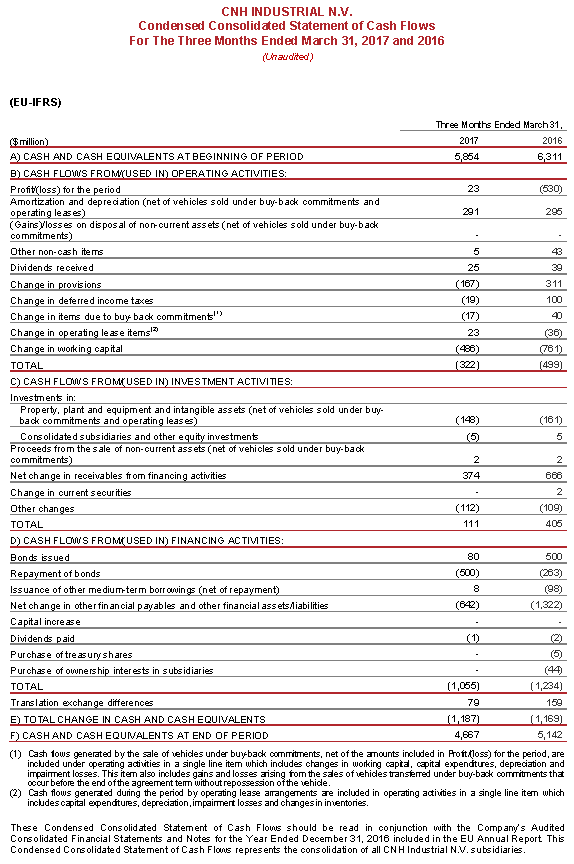

Net industrial debt of $2.1 billion at March 31, 2017 increased by $0.6 billion from December 31, 2016. Industrial operations cash flow was an outflow of $0.5 billion in the first quarter of 2017 as a result of increased inventory to meet seasonal demand. Industrial operations cash flow improved $0.1 billion compared to the first quarter of 2016. Total debt of $24.5 billion at March 31, 2017, was down $0.8 billion compared to

December 31, 2016. As of March 31, 2017, available liquidity(1)(2) was $7.6 billion, down $1.2 billion compared to December 31, 2016. In April 2017, CNH Capital LLC issued $500 million in principal amount of 4.375% Notes due 2022, and the Company announced today the early redemption of all of the outstanding $636 million in principal amount of Case New Holland Industrial Inc. 7⅞% Senior Notes due 2017.

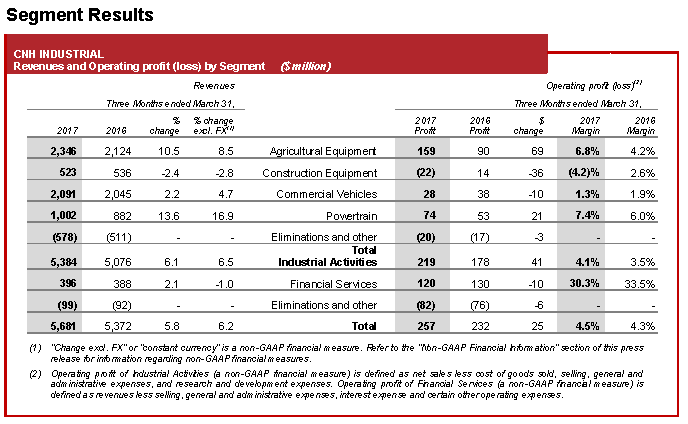

Agricultural Equipment’s

Agricultural Equipment’s net sales increased 10.5% in the first quarter of 2017 compared to the first quarter of 2016 (up 8.5% on a constant currency basis), as a result of a strong rebound in demand in LATAM and the continuation of positive market momentum in APAC. Revenue in NAFTA and EMEA were flat to slightly down due to a weak demand environment, partially mitigated by positive pricing. Operating profit was $159 million in the first quarter ($90 million in the first quarter of 2016). Operating margin increased 2.6 p.p. to 6.8% compared to the first quarter of 2016, as a result of increased revenues in LATAM and APAC, as well as improved fixed cost absorption, disciplined net price realization and manufacturing efficiencies.

(1) This item is a non-GAAP financial measure. Refer to the “Non-GAAP Financial Information” section of this press release for information regarding non-GAAP financial measures.

(2) Refer to the specific table in the “Other Supplemental Financial Information” section of this press release for the reconciliation between the non-GAAP financial measure and the most comparable GAAP financial measure.

Construction Equipment’s net sales decreased 2.4% in the first quarter of 2017 compared to the first quarter of 2016 (down 2.8% on a constant currency basis), as a result of a 5% decline in heavy industry demand in NAFTA and continued weak markets in EMEA and LATAM, partially mitigated by market share gains in NAFTA.

Operating loss was $22 million in the first quarter of 2017 (operating profit of $14 million in the first quarter of 2016). Results were affected by a planned slower production schedule in the quarter to maintain appropriate levels of channel inventory, in response to continuing weak market demand. The results were also impacted by a negative price environment driven primarily by sales channel mix in NAFTA, an unfavorable foreign exchange impact on product cost and promotional expenses related to the launch of the new mini-excavator family.

Commercial Vehicles’ net sales increased 2.2% in the first quarter of 2017 compared to the first quarter of 2016 (up 4.7% on a constant currency basis), as a result of favorable truck and bus volume, partially offset by lower specialty vehicles volumes. In LATAM, recoveries in Argentinian truck demand more than offset Brazilian weakness.

Operating profit was $28 million for the first quarter of 2017 (operating margin of 1.3%) compared to $38 million in the first quarter of 2016. The decrease was mainly due to an unfavorable product and market mix in EMEA, lower specialty vehicles volumes and negative foreign currency impacts, partially offset by manufacturing efficiencies and material cost reductions.

Powertrain’s net sales increased 13.6% in the first quarter of 2017 compared to the first quarter of 2016 (up 16.9% on a constant currency basis), as a result of higher volumes. Sales to external customers accounted for 45% of total net sales (44% in the first quarter of 2016).

Operating profit was $74 million for the first quarter of 2017, a $21 million increase compared to the first quarter of 2016, with an operating margin of 7.4%, up 1.4 p.p. compared to the first quarter of 2016 as a result of higher volumes and manufacturing efficiencies.

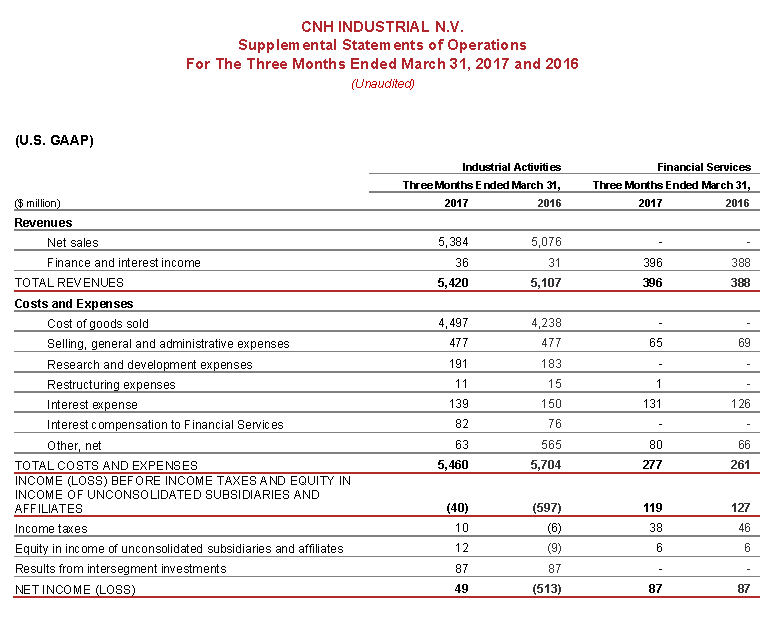

Financial Services’ revenues totaled $396 million in the first quarter of 2017, an increase of 2.1% compared to the first quarter of 2016 (down 1.0% on a constant currency basis). In the first quarter of 2017, retail loan originations (including unconsolidated joint ventures) were $1.9 billion, flat compared to the first quarter of 2016. The managed portfolio (including unconsolidated joint ventures) was $24.7 billion as of March 31, 2017 (of which retail was 64% and wholesale 36%), down $0.2 billion compared to March 31, 2016. Net income was $87 million in the first quarter of 2017, flat compared to the first quarter of 2016.

2017 Outlook

CNH Capital is reaffirming its 2017 guidance(1) as follows:

•

Net sales of Industrial Activities between $23 billion and $24 billion;

•

Adjusted diluted EPS(2) between $0.39 and $0.41;

•

Net industrial debt at the end of 2017 between $1.4 billion and $1.6 billion.

(1) At the exchange rate of 1.05 EUR/USD.

(2) Outlook is not provided on diluted EPS, the most comparable GAAP financial measure of this non-GAAP financial measure, as the income or expense excluded from the calculation of adjusted diluted EPS and instead included in the calculation of diluted EPS are, by definition, not predictable and uncertain.

About CNH Capital

CNH Capital N.V. (NYSE: CNHI /MI: CNHI) is a global leader in the capital goods sector with established industrial experience, a wide range of products and a worldwide presence. Each of the individual brands belonging to the Company is a major international force in its specific industrial sector: Case IH, New Holland Agriculture and Steyr for tractors and agricultural machinery; Case and New Holland Construction for earth moving equipment; Iveco for commercial vehicles; Iveco Bus and Heuliez Bus for buses and coaches; Iveco Astra for quarry and construction vehicles; Magirus for firefighting vehicles; Iveco Defence Vehicles for defence and civil protection; and FPT Industrial for engines and transmissions. More information can be found on the corporate website: www.cnhindustrial.com

Additional Information

Today, at 3:30 p.m. CEST / 2:30 p.m. BST / 9:30 a.m. EDT, management will hold a conference call to present 2017 first quarter results to financial analysts and institutional investors. The call can be followed live online at: http://bit.ly/CNH_Industrial_Q1_2017 and a recording will be available later on the Company’s website (www.cnhindustrial.com). A presentation will be made available on the CNH Capital website prior to the call.

Non-GAAP Financial Information

CNH Capital monitors its operations through the use of several non-GAAP financial measures. CNH Capital’s management believes that these non-GAAP financial measures provide useful and relevant information regarding its results and allow management and investors to assess CNH Capital’s operating trends, financial performance and financial position. Management uses these non-GAAP measures to identify operational trends, as well as make decisions regarding future spending, resource allocations and other operational decisions as they provide additional transparency with respect to our core operations. These non-GAAP financial measures have no standardized meaning presented in U.S. GAAP or EU- IFRS and are unlikely to be comparable to other similarly titled measures used by other companies due to potential differences between the companies in calculations. As a result, the use of these non-GAAP measures has limitations and they should not be considered as substitutes for measures of financial performance and financial position as prepared in accordance with U.S. GAAP and/or EU-IFRS.

CNH Capital non-GAAP financial measures are defined as follows:

•

Operating Profit under U.S. GAAP: Operating Profit of Industrial Activities is defined as net sales less cost of goods sold, selling, general and administrative expenses, and research and development expenses. Operating Profit of Financial Services is defined as revenues less selling, general and administrative expenses, interest expense and certain other operating expenses.

•

Trading Profit under EU-IFRS: Trading Profit is derived from financial information prepared in accordance with EU-IFRS and is defined as net revenues less cost of sales, selling, general and administrative costs, research and development costs, and other operating income and expenses.

•

Operating Profit under EU-IFRS: Operating Profit under EU-IFRS is computed starting from Trading Profit under EU- IFRS plus/minus restructuring costs, other income (expenses) that are unusual in the ordinary course of business (such as gains and losses on the disposal of investments and other unusual items arising from infrequent external events or market conditions).

•

Adjusted Net Income (Loss): is defined as net income (loss), less restructuring charges and non-recurring items, after tax. In particular, non-recurring items are specifically disclosed items that management considers rare or discrete events that are infrequent in nature and not reflective of on-going operational activities.

•

Adjusted Diluted EPS: is computed by dividing Adjusted Net Income (loss) attributable to CNH Capital N.V. by a weighted-average number of common shares outstanding during the period that takes into consideration potential common shares outstanding deriving from the CNH Capital share-based payment awards, when inclusion is not anti- dilutive.

•

Adjusted Income Taxes: is defined as income taxes less the tax effect of restructuring expenses and non-recurring items and non-recurring tax charges.

•

Adjusted Effective Tax Rate (Adjusted ETR): is computed by dividing a) adjusted income taxes by b) income (loss) before income taxes and equity in income of unconsolidated subsidiaries and affiliates, less restructuring expenses and non-recurring items.

•

Net Debt and Net Debt of Industrial Activities (or Net Industrial Debt): CNH Capital provides the reconciliation of Net Debt to Total Debt, which is the most directly comparable measure included in the consolidated balance sheets. Due to different sources of cash flows used for the repayment of the debt between Industrial Activities and Financial Services (by cash from operations for Industrial Activities and by collection of financing receivables for Financial Services), management separately evaluates the cash flow performance of Industrial Activities using Net Debt of Industrial Activities.

•

Available Liquidity: is defined as cash and cash equivalents plus restricted cash and undrawn committed facilities.

•

Change excl. FX or Constant Currency: CNH Capital discusses the fluctuations in revenues and certain non-GAAP financial measures on a constant currency basis by applying the prior year exchange rates to current year’s values expressed in local currency in order to eliminate the impact of foreign exchange rate fluctuations.

The tables attached to this press release provide reconciliations of the non-GAAP measures used in this press release to the most directly comparable GAAP measures.

Forward-looking statements

All statements other than statements of historical fact contained in this earning release including statements regarding our competitive strengths; business strategy; future financial position or operating results; budgets; projections with respect to revenue, income, earnings (or loss) per share, capital expenditures, dividends, capital structure or other financial items; costs; and plans and objectives of management regarding operations and products, are forward-looking statements. These statements may include terminology such as “may”, “will”, “expect”, “could”, “should”, “intend”, “estimate”, “anticipate”, “believe”, “outlook”, “continue”, “remain”, “on track”, “design”, “target”, “objective”, “goal”, “forecast”, “projection”, “prospects”, “plan”, or similar terminology. Forward-looking statements are not guarantees of future performance. Rather, they are based on current views and assumptions and involve known and unknown risks, uncertainties and other factors, many of which are outside our control and are difficult to predict. If any of these risks and uncertainties materialize or other assumptions underlying any of the forward-looking statements prove to be incorrect, the actual results or developments may differ materially from any future results or developments expressed or implied by the forward-looking statements. Factors, risks and uncertainties that could cause actual results to differ materially from those contemplated by the forward-looking statements include, among others: the many interrelated factors that affect consumer confidence and worldwide demand for capital goods and capital goods-related products; general economic conditions in each of our markets; changes in government policies regarding banking, monetary and fiscal policies; legislation, particularly relating to capital goods-related issues such as agriculture, the environment, debt relief and subsidy program policies, trade and commerce and infrastructure development; government policies on international trade and investment, including sanctions, import quotas, capital controls and tariffs; actions of competitors in the various industries in which we compete; development and use of new technologies and technological difficulties; the interpretation of, or adoption of new, compliance requirements with respect to engine emissions, safety or other aspects of our products; production difficulties, including capacity and supply constraints and excess inventory levels; labor relations; interest rates and currency exchange rates; inflation and deflation; energy prices; prices for agricultural commodities; housing starts and other construction activity; our ability to obtain financing or to refinance existing debt; a decline in the price of used vehicles; the resolution of pending litigation and investigations on a wide range of topics, including dealer and supplier litigation, follow-on private litigation in various jurisdictions after the recently settled EU antitrust investigation announced on July 19, 2016, intellectual property rights disputes, product warranty and defective product claims, and emissions and/or fuel economy regulatory and contractual issues; our pension plans and other post-employment obligations; political and civil unrest; volatility and deterioration of capital and financial markets, including further deterioration of the Eurozone sovereign debt crisis, possible effects of Brexit, political evolutions in Turkey, terror attacks in Europe and elsewhere, and other similar risks and uncertainties and our success in managing the risks involved in the foregoing. Further information concerning factors, risks, and uncertainties that could materially affect the Company’s financial results is included in our annual report on Form 20-F for the year ended December 31, 2016, prepared in accordance with U.S. GAAP and in the Company’s EU Annual Report at December 31,

2016, prepared in accordance with EU-IFRS. Investors should refer to and consider the incorporated information on risks, factors, and uncertainties in addition to the information presented here.

Forward-looking statements speak only as of the date on which such statements are made. Furthermore, in light of ongoing difficult macroeconomic conditions, both globally and in the industries in which we operate, it is particularly difficult to forecast our results and any estimates or forecasts of particular periods that we provide in this earnings release are uncertain. Accordingly, investors should not place undue reliance on such forward-looking statements. We can give no assurance that the expectations reflected in our forward-looking statements will prove to be correct. Our outlook is based upon assumptions relating to the factors described in the earnings release, which are sometimes based upon estimates and data received from third parties. Such estimates and data are often revised. Our actual results could differ materially from those anticipated in such forward-looking statements. We undertake no obligation to update or revise publicly our outlook or forward-looking statements. Further information concerning CNH Capital and its businesses, including factors that potentially could materially affect CNH Capital’s financial results, is included in CNH Capital’s reports and filings with the

U.S. Securities and Exchange Commission (“SEC”), the Autoriteit Financiële Markten (“AFM”) and Commissione Nazionale per le Società e la Borsa (“CONSOB”).

All future written and oral forward-looking statements by CNH Capital or persons acting on the behalf of CNH Capital are expressly qualified in their entirety by the cautionary statements contained herein or referred to above.

Contacts

Media Inquiries

United Kingdom

Richard Gadeselli

Tel: +44 207 7660 346

Laura Overall

Tel: +44 207 7660 338

Investor Relations

United Kingdom

Federico Donati

Tel: +44 207 7660 386

United States

Noah Weiss

Tel: +1 630 887 3745

E-mail: mediarelations@cnhind.com www.cnhindustrial.com